Top 10 biggest gold mining companies in the world

Global gold production hit another record just shy of 109m troy ounces in 2018, up more than 23m ounces since the start of the decade.

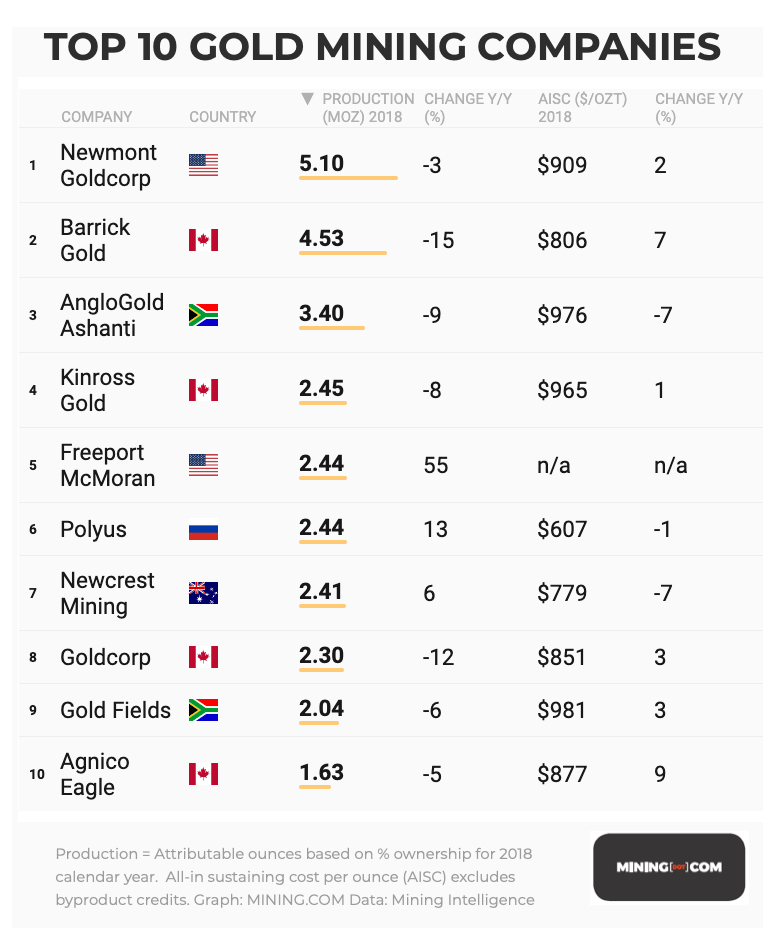

The ranks of the top producing companies stayed remarkably stable, but last year saw a new company take the top spot – and that’s even before the flurry of mergers in the industry’s top tier.

Long-time leader Barrick Gold produced 4.5m attributable ounces in 2018, 15% below the previous year, losing its top-producer status to Newmont Mining. Newmont mined 165koz fewer last year but managed to hold output above 5m ounces.

Had the mergers been in place during 2018, Newmont Goldcorp’s total would have jumped to 7.4m ounces while combined Barrick Randgold would have unearthed 5.8m ounces. Gold production at Newmont and Barrick’s JV in Nevada, inked earlier this year, works out to 4.1m ounces.

Thanks to a surge in gold production at Grasberg in the final years of open pit operations at the Indonesian mine, Freeport edges out Polyus for the number 5 spot. While Grasberg will be pouring much less this year, Polyus is poised to take the number 4 spot from Kinross Gold.

Kinross beat Polyus by just 14,000 ounces, but considering that the Canadian company reports gold-equivalent ounces, the fast-growing Russian company may be already there.

The top tier has a very competitive midfield – with Goldcorp sliding from fifth to eighth, a mere 150,000 ounces covers the middle of the pack.

South Africa’s Harmony Gold increased production by 30% last year to more than 1.4m ounces and would have made the top 10 for the first time were it not for Grasberg’s excellent year.

In all, 15 gold miners now belong to the 1moz-plus annual output club with China’s Zijin Mining bringing up the rear.

The top 10 listed, non-state owned gold miners are responsible for nearly 30% of global output.

Here’s the 2018 ranking using data provided by MINING.COM’s sister company Mining Intelligence, company reports and public filings compiled by senior analyst Vladimir Basov.

Image of old pour at Gold Reef City in Johannesburg, South Africa by Dan Brown.

NOW READ: Mining’s unlikely heroines – Greta Thunberg and AOC

Exponential expansion of global mining is the dirty little secret – and glaring blind spot – of Green New Deal evangelists and zero-carbon climate warriors

7 Comments

Robert Kalkoene

Will the National Banks increase their holding of Gold for the near future and is Bitcoin a problem in the furture

Mike Wismeyer

Hallo Robert, ..long time no see ..hope you & Babs doing great,…if you get this please send me a quick email so we can reconnect,…stuck in Singapore,..cheers Mike

Ampem Enoch

There’s no denying fact that newmont goldcorp is the best mine the recent time….

Well-done my company….

Happy to be working with such a brighter company

Nana yaw

Anglogold ashanti is in Ashanti Region, GHANA not south Africa.

Frik Els

The flag represents the head office of the company. AngloGold Ashanti is headquartered in Johannesburg, South Africa, although that may change as it disposes of its assets in that country.

David Agyemang

Get your fact clear Nana Yaw Anglogold Ashanti is from SA but have operations in Ghana that is obuasi and Tarkwa .

Raymond

Thanks for the information